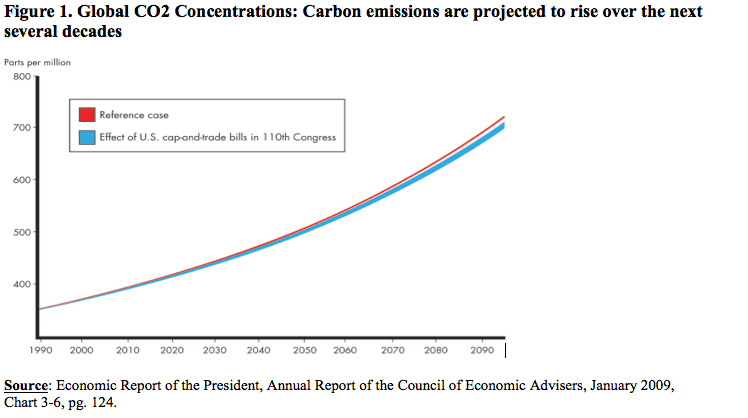

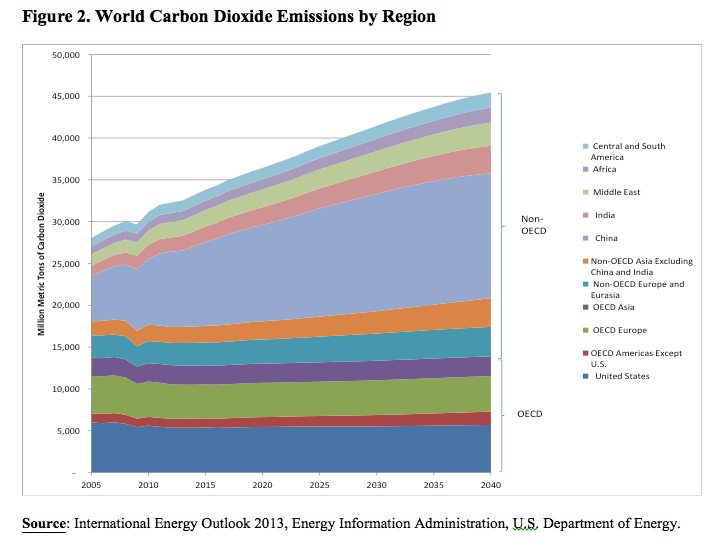

Despite what some policymakers may assert, the U.S. is not facing a shortage of energy. Domestic oil production has increased by 25 percent over the 2005-2012 period and oil imports are down sharply. Natural gas production has increased even faster, rising by 33 percent over the same period. Wind and solar power have also made strong gains as well thanks to renewable portfolio standards in 30 states as well as subsidies like the production tax credit (PTC) and investment tax credits for renewable energy. As policymakers confront the sluggish U.S. economic recovery and slow job growth, they need to consider the impact of tax, budget and regulatory decisions that promote the use of costly renewable energy compared to the expansion of conventional fossil fuels or nuclear power for electricity generation and for transportation. Another factor to consider as policymakers debate subsidies for new energy technology deployment is that, as is widely understood, the impact of U.S. reductions in GHGs will have almost no impact on the growth in global GHG concentrations since most emission growth is in developing countries like China, India, Indonesia and in Latin America (see Figures 1 and 2).

Furthermore, according to recent EIA data, new electric generating capacity using wind and solar power tends to be considerably more expensive than conventional natural gas and coal. For example, the total cost of offshore wind, at $222 dollars per mega watt hour (MWH) is almost 240% higher than for advanced combined cycle natural gas–fired plants which cost only $66 per MWH. The cost of solar thermal, at $261 MWH, is almost 300% higher than natural gas-fired electricity production. Similarly, advanced nuclear costs an estimated $108 per MWH and advanced coal costs only $123 per MWH.[1]

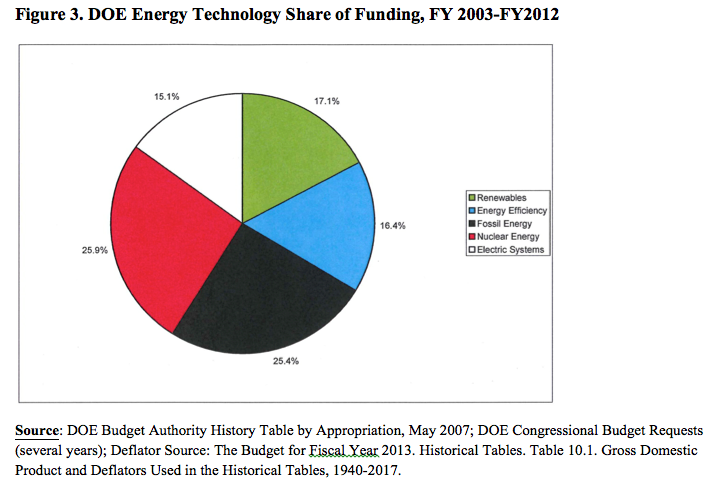

Thus, especially in times of tight budgets, careful cost/benefit analysis should be applied before taxpayer dollars are spent on incentivizing the deployment of renewable technologies. The recent federal government technology deployment failures of many projects like Solyndra and Fisker Automotive demonstrate that government project managers are generally not very good at picking technologies that will succeed in the market place. According to a report by the Congressional Research Service, the U.S. Department of Energy has spent $39.9 billion dollars on energy technology development 2003-2012 period.[2] Approximately half of that amount was spent on renewables; energy efficiency and electric systems technology development (see Figure 3).

According to a new CRS report, “Energy Tax Policy: Issues in the 113th Congress, energy related tax expenditures and tax provisions for fossil and renewable energy and energy efficiency total $84.5 billion dollars over the 2013-2017 period. [3] Reducing federal spending and the deficit will require going over these expenditures and eliminating the ones that do not meet the cost benefit test. For example, the cost of the 2.3 cents production tax credit (PTC) for wind, closed-loop biomass and geothermal energy is $9.7 billion over the five year period.[4] In addition, according to a recent report by the National Academy of Sciences, “Effects of U.S. tax Policy on Greenhouse Gas Emissions,” the tax system is an ineffective mechanism for combating climate change.[5] As a result, “current tax expenditures and subsidies are a poor tool for reducing greenhouse gases and achieving climate-change objectives.” The NAS study, which assumed that all tax policies in place or expiring in 2011 would be renewed through 2035, found that the PTC actually has very little impact on U.S. greenhouse gas emissions. Over the last several years, production tax credits for renewables have greatly increased the rate of wind and solar energy deployment, but for greenhouse gases, “the impact is small.”

Also, provisions in the tax code which allow oil and gas companies to deduct items like intangible drilling costs, geophysical and geologic expenses and percentage depletion should not be called subsidies but should be considered the same as the tax code provisions that allow a fast food chain to deduct its labor cost and using LIFO for inventory expenses. When companies drill for oil or gas, they incur IDCs which are largely the labor costs of locating and drilling wells. IDCs are costs that cannot be recovered as they have no salvage value (in contrast to the drill pipe and casing itself, which is a “tangible asset” and is subject to depreciation). It is noteworthy that all other natural resource industries (e.g., minerals and coal production) have almost precisely the same rules as apply to oil and gas and other industries, such as software development and pharmaceuticals, are able to expense research and development costs. Similarly, geological and geophysical costs are expenses that include the costs incurred for geologists, seismic surveys, and the drilling of core holes; like IDCs, they have no salvage value. Further, percentage depletion, available only to small, marginal independent oil and gas companies, is analogous to a fast food chain using LIFO (last in first out) accounting for the cost of hamburger meat since if the price of oil or gas rises the producer will have to pay more to replace its reserves and maintain production levels once the marginal well is exhausted.

Finally, the best way to provide a level playing field for the deployment of all types of energy technology, both conventional as well as renewable and alternative technologies is to allow expensing of all new investment. Research comparing the impact of a consumption tax under which all investment is expensed shows that it would provide the strongest boost to economic and job growth.[6] If that type of tax reform cannot be implemented at present, many public finance experts suggest that the tax code should provide the same provisions for all types of industries and activities so as to avoid advantaging one industry over another. If markets are allowed to select the energy technologies that are deployed rather than government officials using tax incentives, subsidies or a clean energy standard mandate, costs to consumers and the federal government’s budget will be reduced.

[4] Ibid.

[6] See http://accf.org/news/publication/switching-to-a-consumption-based-tax-from-the-current-income-tax and Joint Committee on Taxation, “Tax Modeling Project and 1997 Tax Symposium Papers,” November 20, 1997. https://www.jct.gov/publications.html?func=startdown&id=2940