The University of Texas recently published an interesting study on American views towards natural gas, hydraulic fracturing, and liquefied natural gas exports. This study will inevitably be used by anti-LNG advocates to support their position.

The University of Texas recently published an interesting study on American views towards natural gas, hydraulic fracturing, and liquefied natural gas exports. This study will inevitably be used by anti-LNG advocates to support their position.

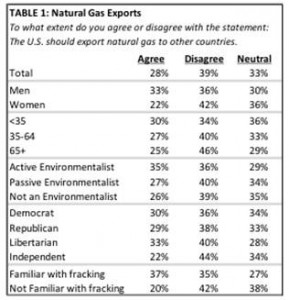

The study was circulated to reporters by Senate Energy and Natural Resources Committee majority staff illustrate that Americans don’t want natural gas exports. The study shows by an almost three-to-two margin Americans are opposed to the exports of natural gas. To summarize the study, this would be correct: 39 percent said they opposed to natural gas exports and 28 percent said they’re for it.

However, like any good poll, the study asks the individuals just how familiar with natural gas they are. It turns out that those who are familiar with natural gas production (ie. “fracking”) are supportive of LNG exports, and even people who describe themselves as “Active Environmentalist” are evenly split on the issue. The people who are not familiar with “fracking” are opposed towards it, and, perhaps tellingly, the strongest group opposed to LNG exports is “greater than age 65”.

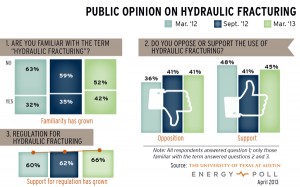

What do we make of this? The study also asked individuals their attitudes towards regulation of natural gas and the numbers indicate that people are overwhelmingly supportive of regulation – almost 62%. Yet, over the past six months, as more individuals have become familiar with natural gas, and also felt that it should be regulated, the more they were also in favor of hydraulic fracturing.

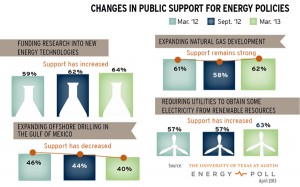

Therefore, the real question that a poll should ask is, “Are you in favor or opposed to exporting regulated natural gas?” Natural gas production has expanded by 29 percent from 2006-2012 due to new technologies that have allowed for the safe development of shale gas. And Americans more than anything else want jobs, and a better economy.

It would be natural to think that by common sense most Americans are in favor of

exports, as long as they aren’t harmful.

Interior Secretary Sally Jewell said new hydraulic fracturing regulations will be released in coming weeks.

What is the opposition to natural gas exports?

ACCF recently sat down with three energy and economic scholars to explore the topic, “Should Free Trade Principles Apply to U.S. Exports of Liquefied Natural Gas?” We discussed the general public’s perception of the LNG export issue. During the conversation, Michael Levi, the Director of the Council on Foreign Relation’s (CFR) program on energy security and climate change noted that a primary driver of opposition to LNG is how slightly higher natural gas prices could be a burden on U.S. industry, forgetting that “there are opportunities in the production of the natural gas that would arise from exports that would benefit U.S. industry and workers.”

“There has been a focus on energy intensive manufacturing which pays a decent fraction of its cost on energy and on natural gas. But if you look at natural gas development and shale gas development in particular, it’s quite intensive in some of these commodities. It uses a lot of steel and a lot of cement,” Levi explained. “So new demand for natural gas from exports would actually help some of these industries by increasing demand for their products.”

Jagdish Bhagwati, a University Professor, Economics and Law, at Columbia University and Senior Fellow in International Economics at the Council on Foreign Relations contended that even if natural gas prices rise from LNG exports, the effect will be “relatively miniscule.”

Richard Schmalensee, a Professor of Economics and Management, Emeritus at the Massachusetts Institute of Technology and Director of the MIT Center for Energy and Environmental Policy Research at the MIT Sloan School of Management concurred.

“In addition, U.S. natural gas prices are now at historically low levels and are at low levels internationally. The notion that the small domestic price increases that are likely from exports would change that ignores the fact that the costs of liquefying and transporting natural gas are significant relative to current domestic prices. So the existence of exports isn’t going to make the U.S. domestic price equal to prices elsewhere that are determined by the costs of LNG imports.”

“To try and figure out which industry will be hurt more and which less is hardly a productive use of our skills and time. Change is continual and prices change all the time; entrepreneurs have to get used to such changes instead of trying to insulate themselves through lobbying-led interventions,” Professor Baghwati added.

All experts agreed that free-trade must drive America’s LNG policies, a sentiment that was echoed by former Sens. Bennett Johnston and Byron Dorgan at a House Energy and Commerce Committee on May 7.

“Markets are dynamic. There are many factors which are working which change by the month. Some change daily,” Johnston, a former Senate Energy and Natural Resources chairman, told the committee. “All of those things are working rapidly and the way to allocate that great beneficence of natural gas is to let the market do it because it can react faster than the regulators can react.”

Dorgan, a co-chairman of the Bipartisan Policy Center’s Energy Project echoed the free market approach to natural gas exports. “We believe the market should make the decision about the exports of natural gas.”

On May 21, the Senate Energy & Natural Resources committee will hold a forum to “examine estimates of domestic supply and the potential benefits or unintended consequences caused by expansion of natural gas exports.” Free trade principles should be embraced by the Senate. Even President Obama shares a positive outlook on natural gas exports, noting in his remarks on May 13 that “The United States” will probably be a net exporter of natural gas in somewhere between five and 10 years.”

To learn more about ACCF’s position on LNG exports, visit: http://accf.org/search/LNG